IMF

(International Master Program in Global Finance)

International Innovative Professional Program at the College of Management at National Chung Cheng University

In response to the demand for international banking and finance talents in Asia and in order to cultivate such future talents, the courses are conducted fully in English by 20 cross-department faculty members of the college who have both practical banking and finance background. Emphasis is placed on the ability to integrate interdisciplinary knowledge in financial banking, business administration, accounting, information, information management, finance and banking laws along with theory and practice of global banking market. The goal is to nurture high-level professional financial and banking mangers.

Curriculum features

1. Multi-faceted engagement into finance and banking

Classes are conducted in English with diverse contents that cover interdisciplinary professional capabilities, investment and management of professional organization, language communication capability, and global viewpoints to cultivate financial and banking professionals with varied viewpoints.

2.

Internship opportunity to fortify practical experience

During the summer, we cooperate with the four major domestic accounting firms, banking institutions, and governmental financial

supervisory agency to offer internship opportunities in order the enhance the students' practical competitiveness and

communication competency in the market.

3.

Immersion of international views into daily life

In addition to domestic student, international student are recruited as well. The students can advance their strength in

international financial market from the daily learning process through international exchange of different views.

Recruitment subjects

We recruit domestic and international students who are interested in Asia-Pacific finance and trade with a bachelor degree in business administration from schools approved by the Ministry of Education (or certificate of education equivalency). After the application and selection processes, the accepted students can register to start their education.

1. How to apply

Domestic students are required to apply through Chung Cheng University master's program admission process, the criteria include preliminary examination and written information (50%) and the second-stage oral examination (50%).

International students are required to submit their applications for our program through the university's Office of International Affairs (OIA). Application Period:

(Spring Semester: September 1st ~ October 15th)

(Fall Semester: February 1st ~ March 15th)

2. Program detail

Classes conducted all in English, the level of study is for master’s degree over a period of two years during which a minimum of 36 credits of coursework (including master dissertation, but not including basic prerequisites), cultural exchange activities totaling 54 hours and a master thesis with oral examination must be completed in order to receive a degree in International Master Program in Global Finance, IMF.

3. Curriculum

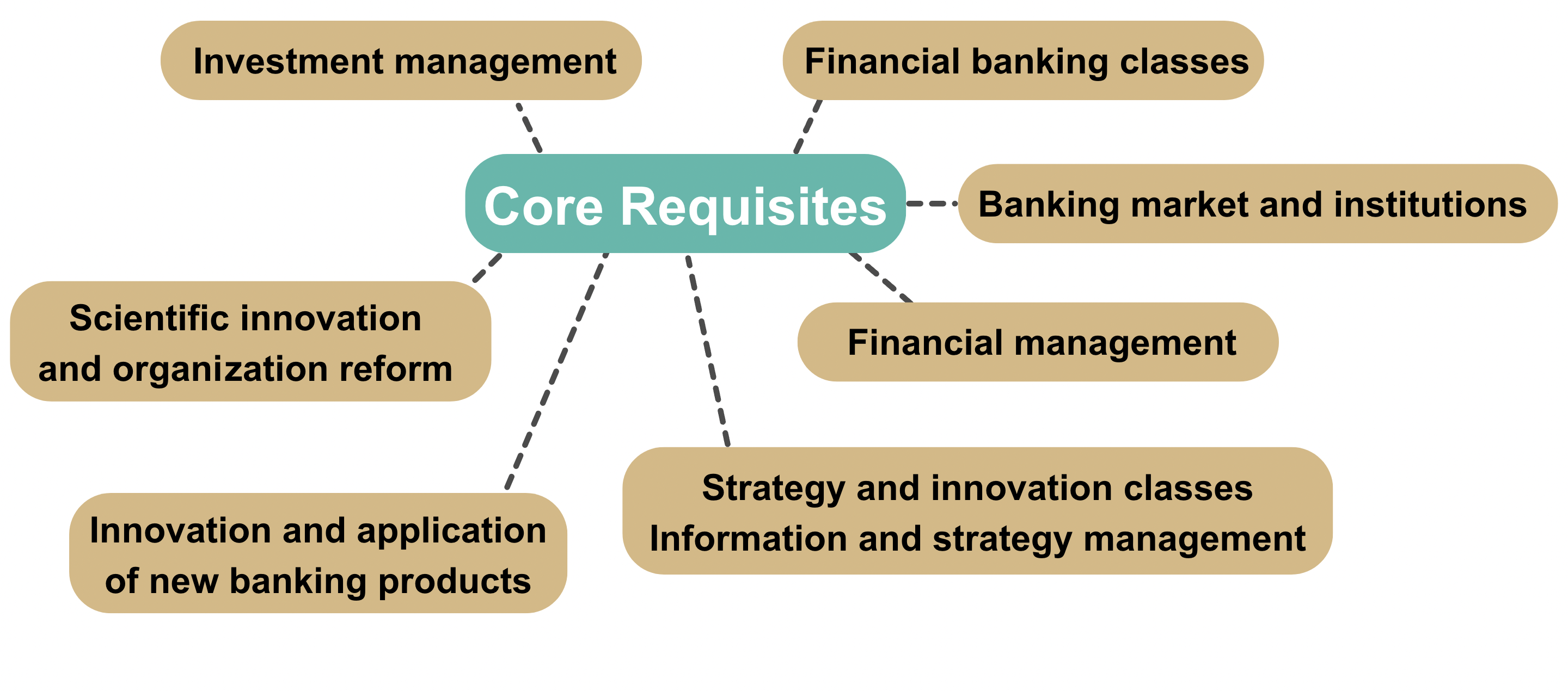

In order to cover both theory and practice, the students must already have completed the basic prerequisite classes, basic business administration knowledge. The courses are core requisites and professional electives with 3 credits for each class respectively.

This infographic titled “Basic Prerequisites” shows three illustrated icons with captions. From left to right, they represent Economics, Accounting, and Statistics.

The infographic titled “Core Requisites” uses a mind-map style diagram to show core course areas including Investment, Financial Banking, Banking Market, and Strategic Management.

The infographic titled “Professional Electives” summarizes elective courses by four work competencies: Interdisciplinary professional capabilities, Investment and management, Language communication, and Global viewpoints.